Making something our of nothing—that’s probably one of the most fitting descriptions for Bitcoin (BTC), the leading cryptocurrency in the market since 2009. This ingenious money is often compared to option trading because of its highly volatile nature. Little did we know that this digital coin could surpass options and futures in terms of value instability. But just how volatile is Bitcoin?

Bitcoin started with a zero value in 2009 to over 60,000 USD in 2021, showing just how unpredictable its price movement is. While many investors worldwide are fascinated with these extreme value fluctuations, BTC’s volatility still has its own set of pros and cons. But before we dive into that, let’s first talk about what Bitcoin volatility is.

What is volatility in Bitcoin?

In the financial world, volatility refers to the price change of an asset over some time. In many cases, the higher the volatility, the riskier the security or asset. When applied in the crypto space, Bitcoin is considered a highly volatile asset since its price can swing in extreme directions—it can either go through the ceiling or take a nosedive.

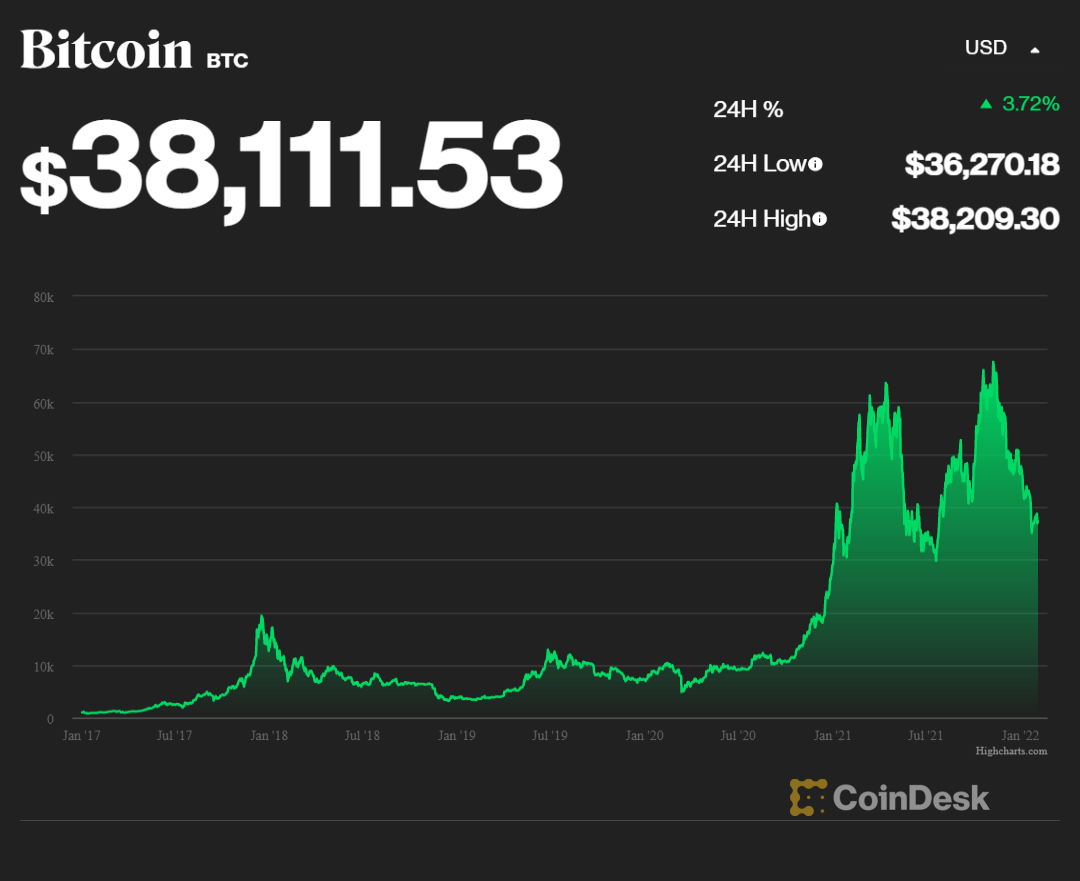

At the time of writing (January 31, 2022), Bitcoin sells for over 38,000 USD per coin. This is a massive jump from 0 USD in 2009. To help you better visualize Bitcoin’s extreme price movements, here’s the BTC price history chart from Coindesk.

Source: coindesk.com/price/bitcoin

Bitcoin has a maximum supply of 21 million BTC. Like any other currency or asset, BTC’s price is affected by the demand and supply in the market. In the graph above, you can see extreme price fluctuations starting from 2017 until 2021. And up to this day, no one can surely tell what the market movements will bring you tomorrow, in the near future, or even while you’re reading this.

The pros and cons of Bitcoin’s volatile nature

After getting the gist of how extremely unpredictable BTC’s price is, let’s now discuss some of the benefits and drawbacks of Bitcoin volatility.

Benefits of BTC volatility

One of the most distinctive features of Bitcoin is that it’s decentralized. It doesn’t have any central authority to run and oversee its operations since blockchain—the powerful technology behind it—can process everything on its own. Miners or those who dig up coins in BTC’s digital cave are in charge of generating new Bitcoins.

Bitcoin also has a limited supply of 21 million BTC, which is the main reason behind its extreme price fluctuations. At the time of writing, Bitcoin has a market capitalization of 1,110,764,303,176 USD and a circulating supply of 18,856,450.00 BTC. This leaves miners with only over 2 million BTC to generate.

Like any other asset, BTC’s value can go sky-high if the demand increases and the supply decreases. On the flip side, its price can collapse if there’s less demand but more supply. Because of the thrill and new kind of financial opportunity Bitcoin volatility offers, trading and investing have become one of the most popular ways to earn income with BTC. Many traders, investors, and crypto enthusiasts worldwide started to explore different approaches to get high investment returns.

The volatility of Bitcoin also drives the worldwide adoption rate to a higher position. Whenever BTC reaches an all-time high, it makes the headlines. People who haven’t tried crypto may begin to create a Bitcoin account and find an exchange to jumpstart their new journey.

Drawbacks of BTC volatility

We’re not going to lie; making accurate Bitcoin price predictions isn’t easy. It shifts quickly, which is another point to consider if you’re looking to use it for short-term trading. From our discussions earlier, you probably now have an idea about how BTC’s price declines and shoots up dramatically. Because of this, many crypto traders, investors, and enthusiasts get the feeling that they’re missing out on the best financial opportunities.

In the crypto space, this uneasy feeling is known as fear of missing out (FOMO). People get FOMO when Bitcoin’s price increases and they don’t have many coins to hold or sell. The same applies to some people when BTC suddenly plunges and they have a lot in their wallets. People who get FOMO will often panic and sell their coins because they fear that the price will dip even further in the next minute or hour.

When this happens, other traders and investors will buy the dip. Some buy Bitcoin with credit cards, mobile wallets, gift cards, and other payment methods available in their location.

The final verdict: Is BTC volatility good or bad?

Bitcoin’s volatility is undeniably sharp. It can be 50,000 USD today and 60,000 USD by tomorrow or the other way around. But from the points we’ve laid out earlier, it’s safe to say that BTC volatility lies somewhere between the two extremes. This volatility allows the coin’s price to soar, but it also makes this asset risky and a little tricky. At the end of the day, it all boils down to how you would allow Bitcoin’s volatility to shape your crypto journey.

The content of this article is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. You should carry out your own independent verification of facts and data, do your own research and may want to seek professional advice before making any decisions.